GCash has partnered with more banks to bolster its GSave service. Initially, there’s GSave by CIMB, then #MySaveUp by BPI, and EzySave+ by Maybank. We recently opened an account with the latter, so we’ll share our experience below.

The Maybank EzySave+ account can be accessed by launching your GCash app and then tapping on GSave. From here, you will see that it’s still in beta but already accepting new clients.

Tapping on it will launch an in-app browser, directing you to the Maybank Philippines website and some info on the benefits when you open an account:

• No maintaining balance required and comes with free insurance.

• Get a free Visa debit card when you deposit PHP 1,000USD 17INR 1,445EUR 16CNY 124.

• Enjoy limitless deposits and higher interest on your balance.

• Withdraw for free from any BancNet ATM

Maybank says that EzySave+ processes applications from 4:00 AM to 11:49 PM only.

Tap on the ‘OPEN EzySave+ ACCOUNT’ to get started.

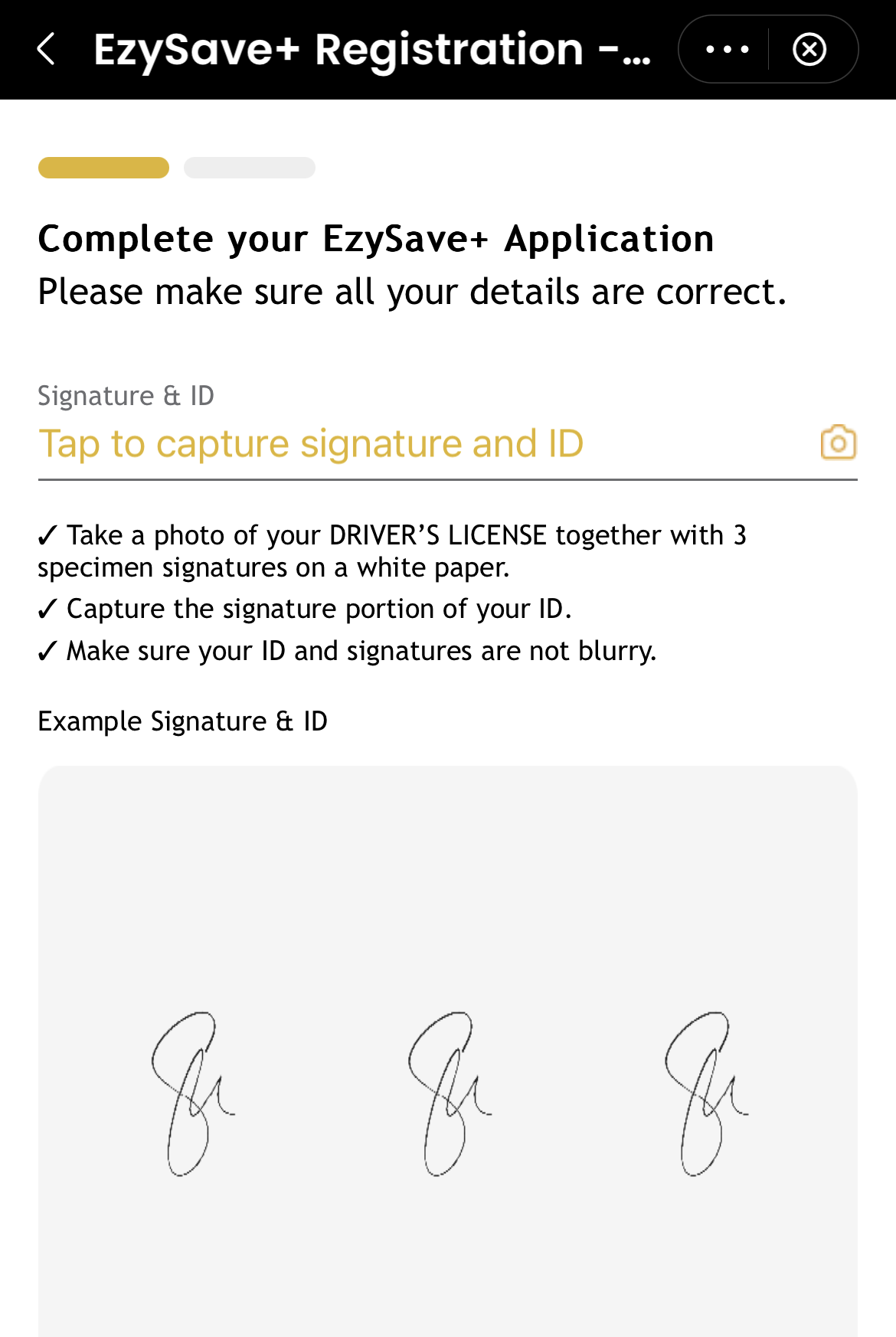

Step 1:

The next step requires you to take a photo of your ID that includes a signature. In our case, we just used our driver’s license. It also requires 3 specimen signatures on a white paper but it seems like a photo of the ID is more than enough as it allowed us to go to the next step.

Step 2:

Once the ID is uploaded, you just need to input your personal details. Make sure to use the right mobile number as EzySave+ will send your Transaction Authorization Code (TAC) there (it’s like OTP).

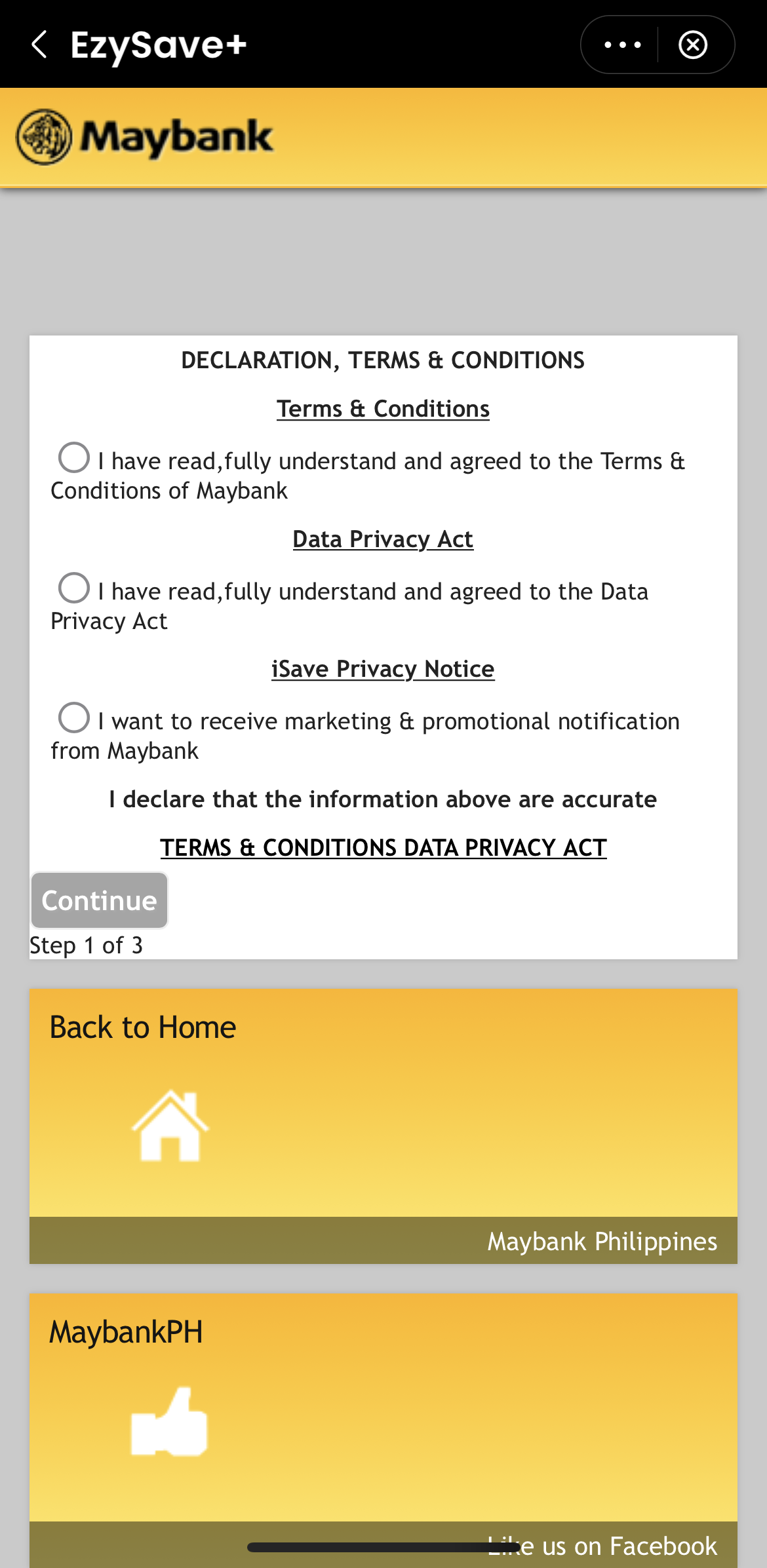

Step 3:

Agree on the terms and conditions and tap on Continue,

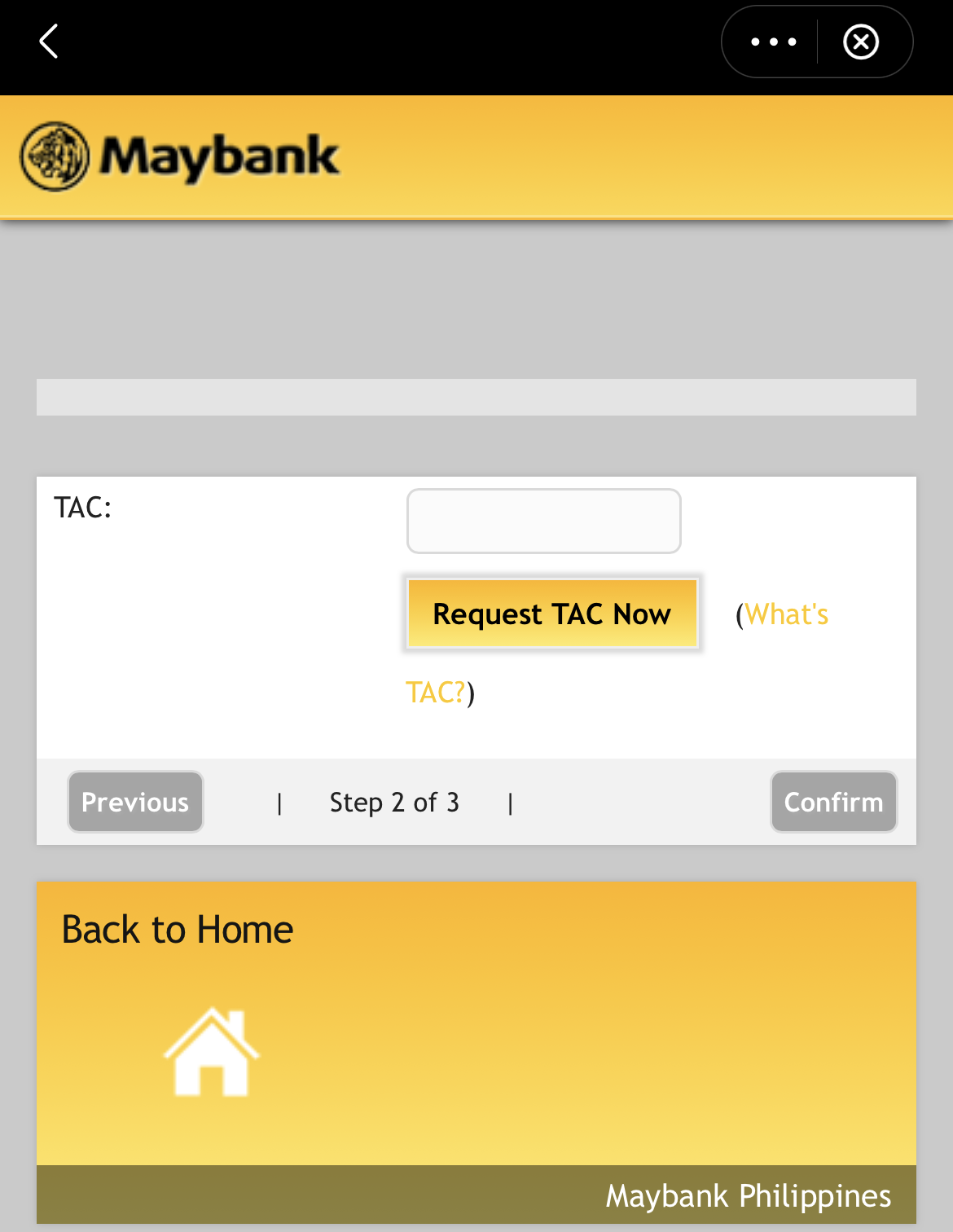

Step 4:

Request for 6-digit TAC, then confirm. And you’re done.

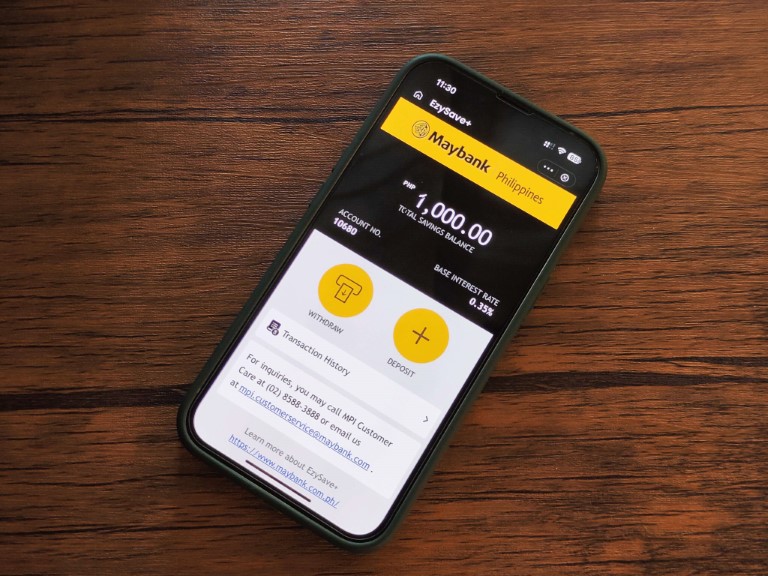

You will be then directed to the dashboard of your account which shows your current balance, account number, and base interest rate.

How does it work?

Although it’s still in beta, the registration went smoothly and using it within the GCash app is convenient. To deposit funds, just tap on Deposit, input the amount, and it will transfer funds from your GCash account to the EzySave+ account. The base interest rate, though, is only 0.35%.

To withdraw, just tap on the Withdraw button, input the amount, and the funds will be transferred right away. You will also receive SMS and email receipts. In addition, all transactions, so far, are free of charge.

How to request a Maybank Visa Debit Card?

Maybank says that you can request it by calling its customer care hotline at (632)85883888 or by visiting any Maybank branch near you. Just make sure you have at least PHP 1,000USD 17INR 1,445EUR 16CNY 124 balance.

And there you have it. If you’re looking for another bank to put your funds in, you can try this one via GSave.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020

Maryann says:

How do transfer my money in Maybank to CIMB

Mars says:

Can I open a second Maybank EzySave+ using a different GCash account, different sim? Same customer name.

John jester Ibay says:

Marssays:

3months

Can I open a second Maybank EzySave+ using a different GCash account, different sim? Same customer name.

John jester Ibay says:

Marssays:

3months

Can I open a second Maybank EzySave+ using a different GCash account, different sim? Same customer name.