Despite the pandemic’s effects to the economy, the technology sector continued to advance the world over. The International Data Corporation (IDC) projects the tech industry to exceed USD 5.3PHP 311INR 449EUR 5CNY 39 trillion by 2022, while Gartner sees global IT spending to reach USD 4.5PHP 264INR 381EUR 4CNY 33 trillion. Among the major drivers of this growth would be industry giants which operate within certain markets.

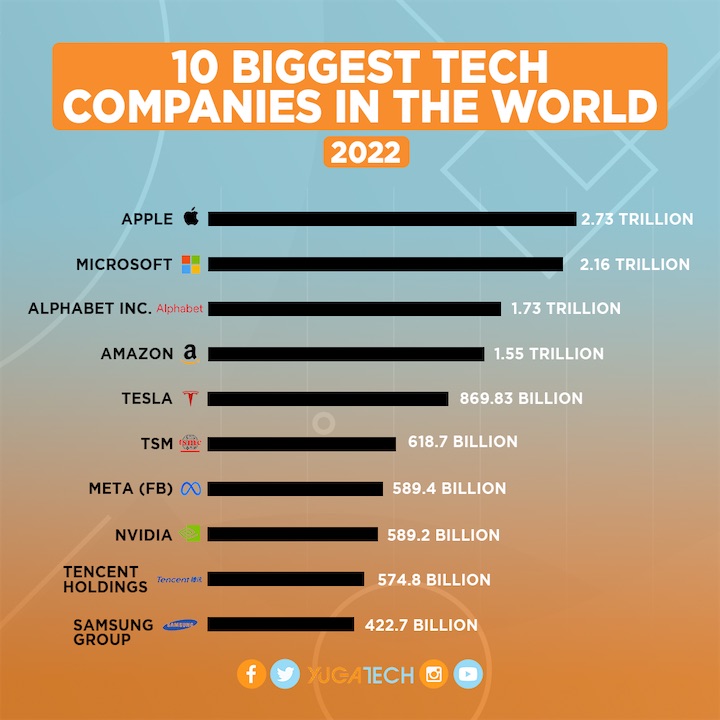

If you are wondering about the profiles of these tech leaders, let us take a look at the global top 10 of tech companies ranked according to market capitalization as of February 2022. Also known as market cap, it refers to the total value of all the company’s shares of stock. You can figure out these figures by multiplying the number of outstanding shares to the market price per share.

10. Samsung Group – USD 422.7PHP 24,806INR 35,824EUR 403CNY 3,077 billion

Now a globally recognized multinational brand, Samsung was founded in Daegu when Korea was under Japanese rule. The first decade of the company was involved in trading groceries such as fish and noodles. Samsung’s foray into electronics was in 1969, when it began to produce home appliances. Today, it is one of the world’s largest electronic manufacturers. Samsung’s current market cap, however, was 7.2 percent lower compared to 2021. Part of this is attributed to sluggish demand for dynamic random-access memory (DRAM), a significant Samsung industry. TrendForce, meanwhile, still ranks Samsung as the world’s leader in the DRAM market for 2021.

9. Tencent Holdings – USD 574.8PHP 33,732INR 48,714EUR 547CNY 4,184 billion

Finding fortune in internet-related technologies, Shenzhen-based Tencent was founded in 1998, and has since become the first Chinese tech company to exceed USD 500PHP 29,343INR 42,375EUR 476CNY 3,639 billion. Among its notable gains was made in the gaming industry, where it has acquired significant stakes in various firms such as Riot Games (League of Legends, Valorant) and Supercell (Clash of Clans, Boom Beach). Compared to 2021 figures, Tencent’s market cap grew by 2.1 percent. The US Trade Representative, however, recently flagged e-commerce sites of Tencent and Alibaba in its list of “notorious markets,” a decision which has already earned Tencent’s strong disagreement.

8. NVIDIA – USD 589.2PHP 34,577INR 49,935EUR 561CNY 4,288 billion

Founded in 1993 with the vision to create the “next version” of graphics processing units (GPUs), Santa Clara-based NVIDIA is regarded as a “fabless” manufacturer. This means while design and marketing would be their specialization, actual fabrication of the chips was outsourced elsewhere. NVIDIA’s market cap recently tumbled by 19.9 percent compared to 2021 figures as cryptocurrency woes leading to plummeting sales of NVIDIA’s cryptocurrency mining GPU, and the collapse of its deal with another chip company called Arm Ltd hounded its prospects. To recall, NVIDIA earlier intended to acquire Arm shares from Japan’s Softbank.

7. Meta – USD 589.4PHP 34,589INR 49,952EUR 561CNY 4,290 billion

Formerly known as Facebook, Menlo Park’s Meta Platforms boasts multiple digital media brands under its care since being established in 2004. The roster of Meta acquisitions included Instagram, WhatsApp, and Giphy, among others. While it remains in the top 10 of tech companies globally, Meta’s market cap suffered a major decline of 37 percent compared to 2021. Bloomberg calls it the “biggest selloff” in Wall Street history as the company contended with a slew of developments such as privacy changes with Android and iOS, weaker than expected revenues, and costs of developing “Metaverse,” the company’s version of augmented and virtual reality.

6. Taiwan Semiconductor Manufacturing Company – USD 618.7PHP 36,309INR 52,435EUR 589CNY 4,503 billion

Ranked along with Samsung and Intel as top chip producers, TSMC is regarded as the world’s largest independent contract semiconductor foundry. Since its creation in 1987, it was largely seen as a pioneer of its business model. TSMC’s “pure-play” model provides a way for “fabless” companies such as NVIDIA to outsource actual fabrication while avoiding competition with any of its contractors and churning out products in line with market demand. This model also distinguishes TSMC from Samsung and Intel, both of which continue to design and produce chips. Its market cap grew 7.4 percent from 2021 figures. With a global chip shortage fueled by the pandemic, TSMC plans to spend up to USD 44PHP 2,582INR 3,729EUR 42CNY 320 billion this year to help alleviate the tech crisis.

5. Tesla – USD 869.83PHP 51,046INR 73,718EUR 828CNY 6,331 billion

Named after the Serbian-American inventor Nikola Tesla, the Austin-based company largely works with electric vehicles (EV) and sustainable energy. Record high revenues and measures to manage supply chain issues, however, appears to have limited impact in mitigating Tesla’s 18 percent decrease in market cap from 2021 figures. Besides a fatal crash and reported camera problems which led to the recall of over 475,000 vehicles, Tesla is also beginning to face stiffer competition with more auto companies emerging in the electric car market. While Tesla still led last year’s EV market with a 14 percent share of global sales, Canalys observed how other EV makers such as Volkswagen (12 percent) and SAIC Motor (11 percent) have been closing the gap.

4. Amazon – USD 1.55PHP 91INR 131EUR 1CNY 11 trillion

Ranked by Kantar as the most valuable global brand of 2021, Amazon started in 1994 with books. From there, the company has expanded into a number of industries like e-commerce, entertainment, and artificial intelligence. Last year, FactSet estimates saw Amazon going past Walmart as the world’s largest retailer outside the People’s Republic of China. It suffered a decline of 8.2 percent from its 2021 market cap, leading to Amazon’s first stock repurchase last month. Meta’s massive market plunge and Amazon’s price hike for its paid subscription service Amazon Prime likely helped buoy the company to post its highest stock price gain since 2015.

3. Alphabet Inc. – USD 1.73PHP 102INR 147EUR 2CNY 13 trillion

A 2015 restructuring program resulted to the consolidation of internet colossus Google and its subsidiaries as Alphabet, aimed at streamlining operations and expanding into new ventures. Since then, the multinational company had also gone into health, robotics, and automotive technology, among others. While Google remains as the world’s most visited website, Alphabet’s market cap went down by 10 percent compared to 2021 figures. Nonetheless, the company’s recent move to split its stock 20-for-1 by July brightened up its prospects to outperform the market. The split essentially meant making individual shares more affordable and accessible.

2. Microsoft Corporation – USD 2.16PHP 127INR 183EUR 2CNY 16 trillion

The software company created in 1975 is the parent of Windows, the world’s most popular operating system (OS) for personal computers. StatCounter indicates Windows OS having nearly 76 percent global market share among desktops as of January 2022. While having a strong background on software generation, Microsoft had since ventured into other industries. One recent development was its extended partnership with FedEx to work on logistics innovation. Meanwhile, its USD 69PHP 4,049INR 5,848EUR 66CNY 502 billion acquisition plan of Activision Blizzard (Call of Duty, Warcraft, Hearthstone, Starcraft) was seen as Microsoft’s bid to make a dynamic entry as a player in the gaming industry. Activision Blizzard’s market cap of USD 63.5PHP 3,727INR 5,382EUR 60CNY 462 billion, however, is currently lower than the stated price. Also, Microsoft suffered a 14.4 percent decrease from its 2021 market cap.

1. Apple Inc. – USD 2.73PHP 160INR 231EUR 3CNY 20 trillion

Hailed as the first American company to reach USD 3PHP 176INR 254EUR 3CNY 22 trillion market cap, which it briefly achieved on January 3, 2022, Apple is still at the top of the world even as its current level was a reduction of 5.9 percent compared to 2021 figures. Initially founded on computer development, it has since diversified its offerings. From digital services to mobile phones and accessories, Apple has built strong demand and equally strong revenues for itself. Apple’s attempt in creating its own “metaverse” through platforms such as ARKit and RealityKit also ensured that it could compete with the likes of Meta, which is also exploring similar territory. One key concern for the company, however, would be sustaining growth if faced by weak hardware demand (e.g., iPhone sales).

While an optimistic technology sector has thus far weathered the economic impacts of the pandemic, it is not necessarily indicative of how long it could hold. Take for example the rising tensions in Ukraine, which may be another stress test for the world’s largest tech companies.

Top 10 Tech Companies

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020