The new tax reform bill has been signed by President Duterte today. The TRAIN, as it is commonly referred to, has adjusted taxes on several categories including a tax exemption on all personal income tax below Php250,000USD 4,260INR 361,150EUR 4,058CNY 31,025 (annually).

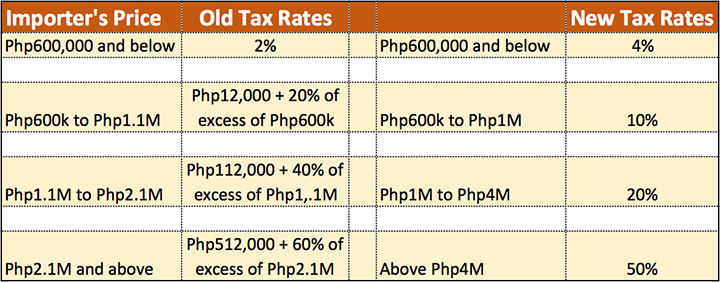

Likewise, automobiles will have a new or simpler tax structure. For cars, the new tax scheme is as follows:

Net Manufacturer’s / Importer’s Price

Up to P600,000 == 4%

P600,000 to 1,000,000 == 10%

P1,000,000 to 4,000,000 == 20%

Above P4,000,000 == 50%

Take note that these are based on Net Manufacturer’s Price or Importers Price.

Here’s a comparison table between the old and the new tax scheme.

Let’s do some examples.

Importer’s Price: Php600,000USD 10,224INR 866,760EUR 9,738CNY 74,460

Base Price (Old Tax): Php612,000USD 10,428INR 884,095EUR 9,933CNY 75,949

Base Price (New Tax): Php624,000USD 10,633INR 901,430EUR 10,128CNY 77,438

Importer’s Price: Php800,000USD 13,632INR 1,155,680EUR 12,984CNY 99,280

Base Price (Old Tax): Php852,000USD 14,518INR 1,230,799EUR 13,828CNY 105,733

Base Price (New Tax): Php880,000USD 14,995INR 1,271,248EUR 14,282CNY 109,208

Importer’s Price: Php1USD 0.02INR 1EUR 0.02CNY 0.12,00,000

Base Price (Old Tax): Php1,092,000USD 18,608INR 1,577,503EUR 17,723CNY 135,517

Base Price (New Tax): Php1,100,000USD 18,744INR 1,589,060EUR 17,853CNY 136,510

Importer’s Price: Php1,500,000USD 25,560INR 2,166,900EUR 24,345CNY 186,150

Base Price (Old Tax): Php1,772,000USD 30,195INR 2,559,831EUR 28,760CNY 219,905

Base Price (New Tax): Php1,800,000USD 30,672INR 2,600,280EUR 29,214CNY 223,380

Importer’s Price: Php2,500,000USD 42,600INR 3,611,500EUR 40,575CNY 310,250

Base Price (Old Tax): Php3,252,000USD 55,414INR 4,697,839EUR 52,780CNY 403,573

Base Price (New Tax): Php3,000,000USD 51,120INR 4,333,800EUR 48,690CNY 372,300

Importer’s Price: Php3,000,000USD 51,120INR 4,333,800EUR 48,690CNY 372,300

Base Price (Old Tax): Php4,052,000USD 69,046INR 5,853,519EUR 65,764CNY 502,853

Base Price (New Tax): Php3,600,000USD 61,344INR 5,200,560EUR 58,428CNY 446,760

Importer’s Price: Php4,000,000USD 68,160INR 5,778,400EUR 64,920CNY 496,400

Base Price (Old Tax): Php5,652,000USD 96,310INR 8,164,879EUR 91,732CNY 701,413

Base Price (New Tax): Php4,800,000USD 81,792INR 6,934,080EUR 77,904CNY 595,680

Importer’s Price: Php5,000,000USD 85,200INR 7,223,000EUR 81,150CNY 620,500

Base Price (Old Tax): Php7,252,000USD 123,574INR 10,476,239EUR 117,700CNY 899,973

Base Price (New Tax): Php6,000,000USD 102,240INR 8,667,600EUR 97,380CNY 744,600

With the Base Price, the dealers will still have to add their gross profit margins as well before we end up with the final selling price.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020

GagoPoliticsPinas says:

Gago talaga ang mga politician sa pinas. Gusto lang nila na bumaba ang price ng mga luxury vehicles na binibili nila. Oh karma where are you na?

deuts says:

I think the base price in your example already includes the margin for the dealer. You mentioned manufacturer’s or importers “price”, not “cost”.

Jude says:

Just looking at the taxes the author computed and if i am to plot this on a graph, the old tax scheme will have a line with + slope, i.e., as the base price increases, tax increases.

For the new scheme, it is also has a + slope but as the base price increases, the tax increases at a lower rate than the old scheme.

Comparing the 2 scheme, old scheme will make you pay higher taxes at each increase in base price. The new scheme is subtle in tax increase as base price increases.

The new scheme aims to raise taxes on new vehicles with base price of 2M and below. Halos lahat ng bagong sasakyan nasa price range na yan.