We regularly buy gadgets to review straight from the US and other regional countries like HK or Taiwan. These are the rare ones or the models that have been released ahead of everyone else. Most of the time, we purchase it online and use our credit card. On other times, we borrow money or credit from a close friend who lives there.

The problem with having someone else to pay for the item is that it is quite hard to pay them back. In some instances, we would use Paypal as a last resort. However, that method can be quite expensive. Paypal applies charges on transfers and then the peso to dollar exchange rate is also a bit high.

Looking for an alternative solution (that is more efficient but with a better rate) actually came as a surprise when I realized I can also send out money abroad via Western Union 24. The other option, which came to mind first, was to just deposit the money to my friend’s bank account or wire it directly to him so he can use it for the purchases I requested.

I’ve been using WU for about a decade now but most of the time, it’s to receive money from clients. It’s actually one of my usual methods of getting remittance payments.

The only other use I have for it is when I send money to the province for my folks. It didn’t actually dawn on me that I can do the same for friends and contacts abroad. The other reason is that I don’t know how much the going rates are.

After a half an hour of browsing through the Western Union site, I got a clearer info on how to go about it and how much it would cost me.

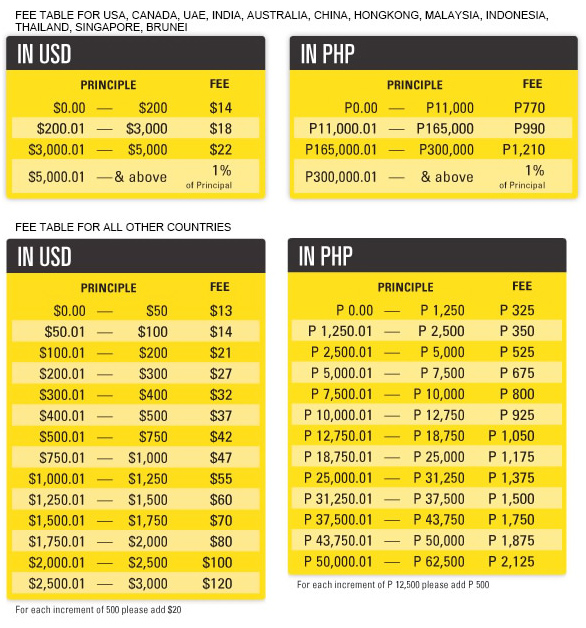

Sending a total amount of Php30,000USD 511INR 43,338EUR 487CNY 3,723 would cost me just Php990USD 17INR 1,430EUR 16CNY 123, which is pretty reasonable. Actually, I could send as much as Php165,000USD 2,812INR 238,359EUR 2,678CNY 20,477 and still pay the same Php990USD 17INR 1,430EUR 16CNY 123. That’s roughly 3.3% for the Php30k and a mere 0.6% for the Php165k.

In my case, I asked a friend to buy my Php30k worth of gadgets from Amazon and bring it with him when he flies to Manila next week. I had to send him the money ahead of time via WU (I paid a total of Php31k, including the remittance fees). Had my friend not planned to go to the Philippines, I had to go thru another method of securing the items.

Here’s the rate table I got from the site:

* Take note though that rates indicated here are applicable to countries listed above. You can check the rate table here: Western Union Money Transfer.

Compare that with a wire transfer through a bank which costs at least $25PHP 1,467INR 2,119EUR 24CNY 182 and takes about 2-4 days to clear with the receiving bank. With WU, it took just a matter of minutes.

Everything else is easy from here on. There’s a lot of WU branches in the metro and there’s actually a couple of them just across the street where I live so that’s one convenience. I was also thinking I can even ask my driver to do the transmittal for me, the same way I’ve been giving instructions to him for my other banking errands.

It looks like Western Union will be top of mind in my succeeding gadget purchases abroad. You can learn more about how to remit money abroad via WU here: Western Union PH.

My personal advise though is that you use all the available security precautions when remitting, like complete and clear instructions as well as a security password.

YugaTech.com is the largest and longest-running technology site in the Philippines. Originally established in October 2002, the site was transformed into a full-fledged technology platform in 2005.

How to transfer, withdraw money from PayPal to GCash

Prices of Starlink satellite in the Philippines

Install Google GBox to Huawei smartphones

Pag-IBIG MP2 online application

How to check PhilHealth contributions online

How to find your SIM card serial number

Globe, PLDT, Converge, Sky: Unli fiber internet plans compared

10 biggest games in the Google Play Store

LTO periodic medical exam for 10-year licenses

Netflix codes to unlock hidden TV shows, movies

Apple, Asus, Cherry Mobile, Huawei, LG, Nokia, Oppo, Samsung, Sony, Vivo, Xiaomi, Lenovo, Infinix Mobile, Pocophone, Honor, iPhone, OnePlus, Tecno, Realme, HTC, Gionee, Kata, IQ00, Redmi, Razer, CloudFone, Motorola, Panasonic, TCL, Wiko

Best Android smartphones between PHP 20,000 - 25,000

Smartphones under PHP 10,000 in the Philippines

Smartphones under PHP 12K Philippines

Best smartphones for kids under PHP 7,000

Smartphones under PHP 15,000 in the Philippines

Best Android smartphones between PHP 15,000 - 20,000

Smartphones under PHP 20,000 in the Philippines

Most affordable 5G phones in the Philippines under PHP 20K

5G smartphones in the Philippines under PHP 16K

Smartphone pricelist Philippines 2024

Smartphone pricelist Philippines 2023

Smartphone pricelist Philippines 2022

Smartphone pricelist Philippines 2021

Smartphone pricelist Philippines 2020

zarne says:

IMO, The best method of payment is credit card (Visa or Mastercard) especially for overseas purchases. No service charge as it is usually absorbed by the merchant. Also most credit cards offer ‘loyalty rewards’ for card members.

Abe Olandres says:

Yes, you are right. Though there are some instances that CC is not allowed like Google Play Store (devices) wherein they only accept US-based cards.

walang kaugnayan says:

The title of the article and the content does not jive! Where is the relation? Yes, WU is well known for its remittance services, but what about for purchases? You did not even cite an example! WTF!

adfadgf says:

so how much is Western Union paying you for this?

raul barrios says:

Wow, that’s a lot of savings right there and quick service too.